Forecast: New high for gold at $3,200 per ounce

- By : Eкип на Вихрогон.бг

- Категория: USA news, Блиц Новини

This is not investment advice. Investing in gold is risky.

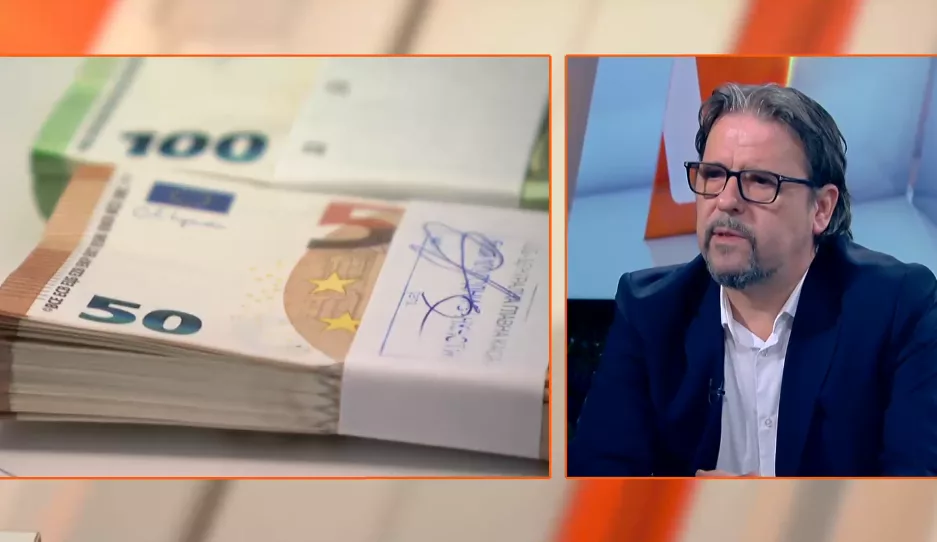

The rise of gold as an investment instrument continues due to the danger of escalating military conflicts and the US trade war. This was commented by Assoc. Prof. Valentina Grigorova-Gencheva, Director of the Gold and Numismatics Directorate at First Investment Bank, investor.bg reported.

The price of gold on world exchanges has passed the psychological threshold of $3,000 per troy ounce, and this morning one troy ounce (31.1034768 grams) on the London Stock Exchange was trading at $3,015.

Grigorova-Gencheva reminded that at the end of last year, in November and December, huge amounts of investment gold were transferred from Europe and Asia to the US. From European vaults alone, it is about 600 tons, and this has also caused a shortage in markets in Asia, where purchases of gold by central banks have affected its price. She emphasized that Asian markets account for just over 60% of the global gold market, with the most significant purchases coming from India, China, Singapore and Hong Kong.

Valentina Grigorova-Gencheva explained that we have been observing a rise in gold as an investment instrument for a century, especially after the pandemic in 2020. “In 2022, banks bought 1,136 tons of gold, in 2024 1,045 tons, which are the highest levels since 1950,” she pointed out. According to her, investments in gold reached a 101% return in five years and 738% in 20 years.

“Inflation could return quite quickly, which is a risk for investors and central banks, and this could increase the price of gold, which could reach $3,200 per troy ounce this year,” the expert predicted.

„Лъвицата “ Пекин обвини Алекс за поредната загуба в “Игри на волята”

„Лъвицата “ Пекин обвини Алекс за поредната загуба в “Игри на волята”

Древна болест надига глава

Древна болест надига глава

Епохална караница между Ваня Григорова и Ники Василев при Карбовски

Епохална караница между Ваня Григорова и Ники Василев при Карбовски

30 литра ракия годишно са крайно недостатъчни според хората

30 литра ракия годишно са крайно недостатъчни според хората

Хората питат: Страх или срам бяха причините Борисов да не отиде на консултации

Хората питат: Страх или срам бяха причините Борисов да не отиде на консултации

Шефът на НАП: Сивите пари се вляха в банките и строителството

Шефът на НАП: Сивите пари се вляха в банките и строителството